Any action you take based on the guidance entirely on cgaa.org is exactly at the discernment. CGAA will not be accountable for people losings and you can/or damages sustained by using every piece of information considering. DEXs introduce unique pressures and you can complexities, especially if considering income tax and regulating conformity. The fresh regulating environment is still changing, and it’s really advisable to have profiles to see an income tax elite group to make certain they are within the compliance along with relevant laws. From the knowledge such factors, you could make informed behavior from the using a good DEX and take actions to help you decrease risks.

It’s in addition to helpful in fixing points including rate effect and you will exchangeability fragmentation. The program enables users so you can change tokens any time, despite its lack of effective counterparties. Including, Uniswap costs an excellent 0.3% payment per exchange, and this happens right to liquidity team.

Top 10 DEX Aggregators to use in the 2025: Wiser Swaps Across the Chains | hyperliquid exchange

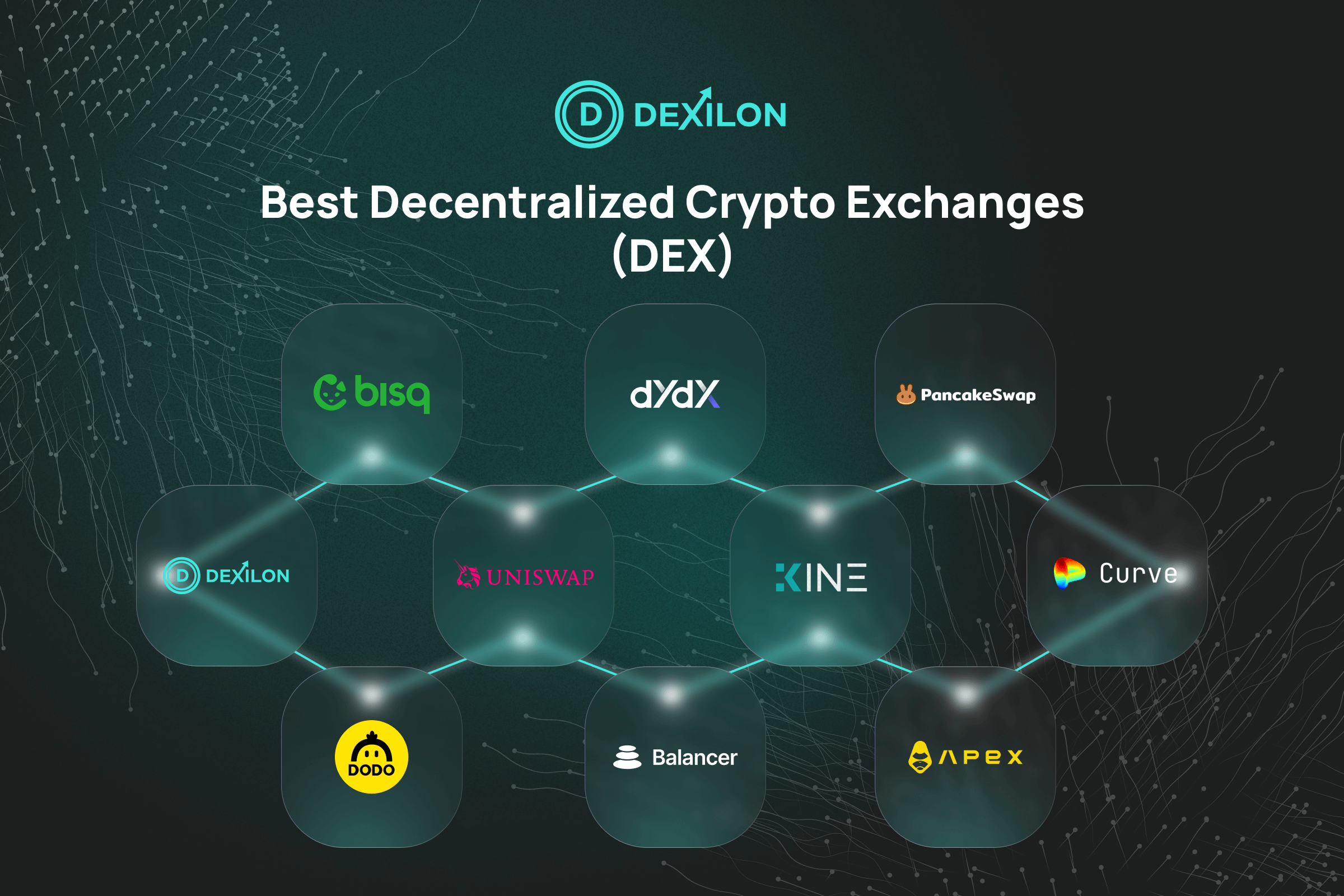

People gain access to customizable trading maps on the dYdX to keep up hyperliquid exchange -to-day for the industry since it moves. The fresh 24-hours change regularity for the dYdX is the second higher which means that the platform life up to its hope from strong liquidity one subsequently professionals people as well. Even when dYdX isn’t just best for specific, it’s a trusted, high-exchangeability decentralized change that is the new wade-to help you choice for complex investors seeking to leveraged contracts.

Central Replace (CEX) versus. Decentralized Exchange (DEX): What’s the real difference?

Along with your typical central replace, you deposit your bank account – possibly fiat (thru bank transfer or borrowing/debit cards) otherwise cryptocurrency. Maybe not away from a function perspective, as you’re able still trade they, but away from a technical view. You must withdraw their fund if you’d like to have fun with they someplace else. On the early days away from Bitcoin, transfers has starred a crucial role in the coordinating cryptocurrency people that have suppliers.

The newest pricing is adjusted algorithmically according to the ratio out of tokens regarding the pond. Instead frequency, people is find issues with liquidity, which may cause slippage. Deals with high slippage will most likely erase any costs-overall performance by using a decentralized exchange to begin with. Because of this UniSwap are our finest possibilities as the better DEX to own exchange crypto. UniSwap try on a regular basis the greatest-regularity decentralized program on the blockchain industries, and frequently by the a critical matter, because the found on the real time study out of CoinMarketCap. In the course of writing, the brand new twenty-four-hr trade regularity are USD 1.4 billion and you will ranked #one in the brand new DEX industry.

ASTER ‚s the native governance and you will power token away from Aster, a great decentralized continuous futures exchange (DEX) readily available for smooth multi-strings trading. Supported by YZi Labs and CZ out of Binance, Aster will capture a percentage of one’s roaring DeFi perpetuals market, which sees hundreds of massive amounts inside monthly regularity. With its previous token age bracket knowledge (TGE) to your September 17, 2025, ASTER have viewed rapid price love, highlighting strong community desire. It Phemex Academy publication dives to the ASTER’s technicians, ecosystem role, and you may potential affect decentralized trade. Dfyn, various other decentralized change, is the first to establish on the-strings limit requests, combining the power of an RFQ coordinating system that have a concentrated exchangeability AMM.

Try an you to goes through DEXs to locate some of the lowest cryptocurrency costs for traders which help remove . Slippage is when insufficient trade frequency causes to find an asset for more than are originally implied or perhaps the selling from an advantage for under try in the first place implied. The brand new 1inch protocol aggregates exchangeability across DEX platforms in order to deepen crypto DEX exchangeability, which counteracts acquisition slippage. Within the November out of 2020, 1inch released v2 of the process, helping round the 21 preferred DEXs.

The new illustration of DODO DEX exhibits the newest request of your Proactive Industry-And make design within the a new decentralized change listing. The brand new Proactive Business And make or PMM build permits the fresh DEX to possess hands-on modification from variables such rates curves within the actual-time for you to enable increased exchange overall performance. Decentralized exchange aggregators are emerging among the finest additions inside the an excellent decentralized exchange listing to own apparent grounds. He could be fundamentally trade standards that work by the sourcing and routing liquidity during the several DEXs considering given criteria. Using software called wallets which can post suggestions to help you a good blockchain, someone keep private secrets to tokens otherwise cryptocurrencies you to definitely act like passwords. Control of the tokens try moved by the ‚sending‘ a cost in order to another organization via a pocket, whoever handbag, therefore, creates a new private key in their eyes.

This article explores the rise out of decentralized exchanges (DEXs) and their impact on the new economic surroundings. It starts by highlighting the development of the original DEX, EtherDelta, inside 2016, and that invited to own unknown token swaps and confronted traditional monetary systems. Even after becoming turn off from the SEC, EtherDelta smooth just how to other DEX systems. This process allows Bend to use better algorithms, ability a low quantities of costs, slippage, and you can impermanent death of any DEX on the Ethereum. Introduced inside the Sep 2020, is the first and you will hitherto premier crypto DEX protocol constructed on . The most popular AMM-powered DEX facilitates token exchanges, staking, and yield agriculture.

Link the newest wallet

DEXs wanted a deeper knowledge of blockchain technical and are finest fitted to experienced users. Decentralized transfers stick out to possess users who need complete control over the crypto and prioritize privacy and you may liberty. One of the primary trade-offs of using a great decentralized replace ‚s the absence of consumer support. To the a central exchange, you might reach out to support groups for individuals who ignore the code, find a technological matter, otherwise create a deal error. When you are CEXs are run by enterprises and you can try to be intermediaries, DEXs cut the fresh middleman completely. Instead, they run-on blockchain technical and you may wise contracts in order to connect consumers and you can suppliers personally.

Investments are performed due to wise deals, and that automatically procedure purchases according to predefined conditions—removing the necessity for a main authority. Particular DEXs, such Uniswap, use automatic market manufacturers in order to assess rate of exchange anywhere between tokens. This can be beneficial, but it is required to recognize how this type of mechanisms work to generate informed change behavior. One of many factors while using a great DEX ‚s the difficulty of one’s platform. Users need to remember the newest important factors and you will passwords on the crypto purses, otherwise their assets are missing forever and should not end up being recovered.